Risk Management

- Addressing Risks and Opportunities

- Hitachi’s Risk Management Structure

- AI Governance-related Initiatives

- Group Governance Efforts

- Compliance Initiatives

- Crisis Management Initiatives

- Efforts Against Investment Risks

- Quantitative Understanding of Risks

- Information Security Initiatives

- Responding to Climate Change Risks and Opportunities

Addressing Risks and Opportunities

Approach & Policy

As digitalization accelerates rapidly and the global political and economic landscape becomes increasingly complex, the business environment is changing every day. In the Risk Management Meeting, which is chaired by the President with the Chief Risk Management Officer (CRMO) acting as vice-chairperson, Hitachi monitors and analyzes the business environment quantitatively and qualitatively and manages risks in terms of the response to risks that Hitachi should prepare for and opportunities for further growth. This approach allows us to create revenue opportunities while controlling risks.

During the Mid-term Management Plan 2024, we have strengthened our risk management system to address risks at an early stage amid the rapidly changing business environment. This has enabled us to mitigate losses and realize stability in profits. More specifically, we have swiftly implemented measures by identifying serious risks that could affect our business, such as changes to the economic environment, including fluctuating exchange rates and interest rates, as well as pandemics, geopolitical risks, and risks related to cyberattacks and information security. We also appropriately manage sustainability-related risks such as human rights and the environment. As growth opportunity is expanding in all three areas of Digital, Green, and Connective and in each region, it is crucial to proactively identify and address both risks and associated opportunities. To accelerate global business growth with One Hitachi, Brice Koch, Executive Vice President and Executive Officer, has been appointed to a dual role as Chief Strategy Officer (CSO) and CRMO from fiscal 2024 and will be responsible for company-wide regional strategies incorporating growth opportunities in each region, balanced with management strategies focused on global risks.

Hitachi’s Risk Management Structure

Structure

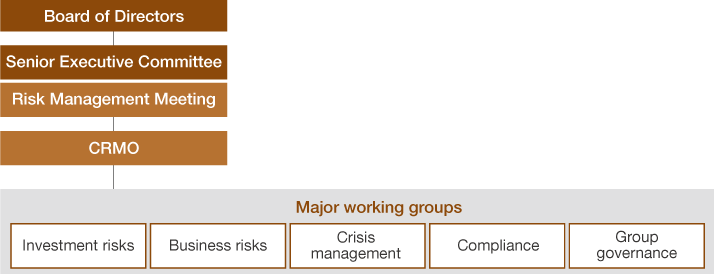

We established working groups (WGs) according to types of risk under the Risk Management Meeting. The WGs utilize related group corporate functions and manage respective risks appropriately.

Risk Management Structure

AI Governance-related Initiatives

Activities

For Hitachi to maintain and strengthen its competitive advantage in a business environment where it is extremely important for companies to obtain results such as improved productivity through the use of AI, employing sophisticated management is necessary to proactively use AI while mitigating the critical risks associated with it.

In February 2021, Hitachi published guiding principles for the ethical use of AI, promoting the establishment of AI governance mechanisms in order to manage risks from the perspective of AI ethics. Hitachi also works to continually evolve its AI governance, developing guidelines governing the internal use of generative AI in August 2023 and expanding the guidelines to cover the provision of external services in March 2024.

Group Governance Efforts

Activities

In April 2023, Hitachi established a Group Governance Policy with the aim of clarifying how the Hitachi Group’s governance should operate and explicitly stating the responsibilities and roles of different organizations given Hitachi’s presence as a global enterprise.

Through this policy, we promote integrated management to (i) formulate and execute the group’s strategies in pursuit of synergies within the group, (ii) strengthen its management foundation through common discipline and rules, and (iii) streamline business management through the standardization of our global operations. Combined with efforts to ensure transparency and fairness in our business management, this enables us to protect the value of the Hitachi brand and accelerate the global growth of the Social Innovation Business.

We are driving initiatives to strengthen group governance and implementation of this policy. For instance, we released a tool to visualize the status and issues related to group governance.

Compliance Initiatives

Activities

As an initiative in fiscal 2023, we formulated and disseminated “Hitachi’s Expectations of Business Partners” regarding ethics and compliance. We have also started Ethical Culture and Compliance Perceptions Assessment targeting some employees and strengthened internal monitoring including our benchmark analysis. In addition, as a part of efforts related to the Hitachi Group Ethics & Compliance Month that is observed each October, we distributed a message from top management and conducted employee training. To coincide with World Whistleblowers Day, we have also conducted PR activities for the Hitachi Global Compliance Hotline through various channels in an effort to foster a culture of Speak-Up.

In fiscal 2024, we will formulate and strengthen compliance rules including the Conflicts of Interest Policy, while continuing to conduct the Ethical Culture and Compliance Perceptions Assessment for all employees and provide ethics and compliance training. We will also promote activities to establish an organizational culture that deters violations of laws, regulations, and internal rules through a range of initiatives including independent compliance audits, the strengthening of our business partner screening platform, and M&A Compliance Due Diligence Guidelines.

Crisis Management Initiatives

Activities

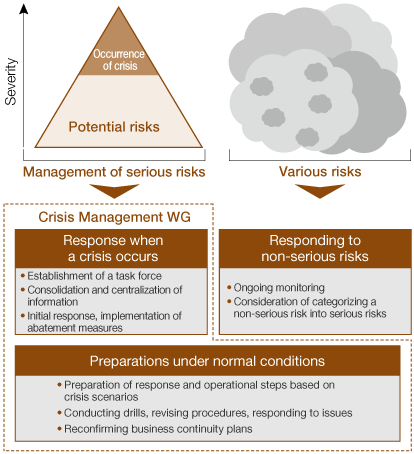

For crisis management, we strive to enhance resilience, including swift response in the event of a crisis. Even in ordinary times, we build readiness for each of the serious risk categories and enhance our systems and responses to contingencies.

In fiscal 2023, we reviewed policies and monitoring methods for evacuation and business continuity in countries and regions with geopolitical risks. We have also worked to strengthen and revise corporate measures to further reinforce our global resilience. Those efforts include supporting the establishment and revision of the Hitachi Group’s business continuity plan (BCP) for largescale natural disasters and clarifying the action guidelines and processes for cybersecurity risks. In fiscal 2024, we will make further efforts to strengthen resilience and improve effectiveness. This will include clarifying the criteria to form a response headquarters in the event of a largescale natural disaster, or in the case of armed conflicts between countries and regional conflicts.

Crisis Management Initiatives

Efforts Against Investment Risks

Activities

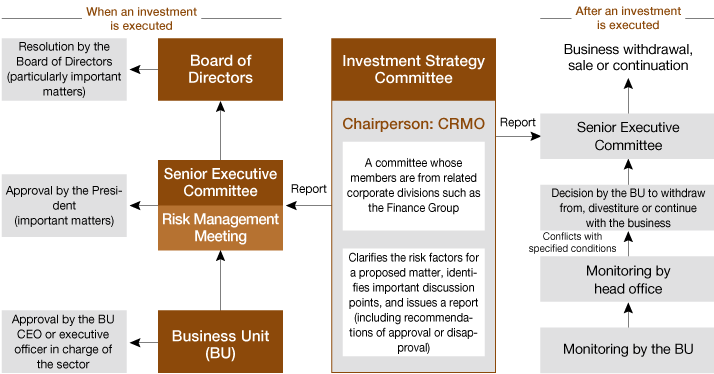

Hitachi has a proper framework of decision-making in different phases of investment (e.g., M&A, sale of assets, orders for projects) to facilitate an appropriate response to risks while securing growth opportunities. Hitachi has a framework for delegation of authority within a three-layer deliberation structure—the Board of Directors, the Senior Executive Committee, and the business units—in accordance with the size and details of the risk to ensure appropriate and flexible decision-making when carrying out an investment or other activity. The Investment Strategy Committee comprises members from corporate divisions selected with a global perspective. For important projects, the committee engages in multifaceted deliberations in terms of the risks, countermeasures, business feasibility, and other factors, and as an advisory body, submits a report (including recommendations of approval or disapproval) to the Senior Executive Committee, which includes the President. After an investment is executed, we periodically monitor the status of the project. If the project fails to proceed as planned, we have internal systems in place to decide whether to continue, which might include discontinuance of a project. The aim is to enhance our capital efficiency. In response to changes in the economy, finance, geopolitics, customers, and other components of the business environment that surrounds Hitachi (risks and opportunities), we continue to enhance the criteria for investment, PMI, and monitoring systems to achieve the Mid-term Management Plan.

Framework of Decision-making

Quantitative Understanding of Risks

Activities

Hitachi calculates expected maximum risks (Value at Risk) by statistical methods according to the type of assets held on the group’s consolidated balance sheet. Similarly, risks associated with the order backlog of long lead projects have been quantified since fiscal 2022. We avoid missing out on growth opportunities by visualizing the capacity for growth investment, etc., considering consolidated net assets and other factors. We also promote risk management including regular monitoring to ensure that risks are not excessively unbalanced compared to Hitachi’s consolidated financial strength. We also quantitatively analyze and understand the state of risks and profitability on a regional and per-sector basis.

Information Security Initiatives

Activities

Hitachi recognizes the increasing risks of information leaks and operational disruptions due to sophisticated cyberattacks and makes every effort to implement cybersecurity measures from both value creation and risk management perspectives. Positioning these activities as a key management priority, we focus on information security, cybersecurity, and data protection.

Information SecurityResponding to Climate Change Risks and Opportunities

Activities

In June 2018, Hitachi announced its endorsement of the recommendations by the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures (TCFD).

Climate-related Financial Information Disclosure (Based on TCFD Recommendations)Moreover, details on risks for our businesses and others are available on page 42 of the Annual Securities Report.

Annual Securities Report (the 155th business term) page 42